Best M&A Law Firms: Your Checklist for Finding the Right Fit

Finding the right legal partner is one of the most critical decisions you’ll make in any merger or acquisition. The stakes are high, and the wrong choice can lead to costly mistakes, missed deadlines, and a deal that falls apart. This guide provides a comprehensive checklist to help you find the best M&A law firms for your transaction, giving you the right team to manage the complexities of your deal and reach a successful outcome. The best law firms for M&A are not always the biggest or most well-known; they are the ones that align best with your specific needs.

Key Takeaways

- The right M&A law firm isn’t always the biggest name, but the one that truly aligns with your goals and deal size.

- Law firms specializing in business law bring sharper industry knowledge, stronger strategies, and a deeper understanding of risks.

- Boutique and regional firms often provide more hands-on service and cost-effective solutions for mid-market deals.

- Transparency in billing, clear communication, and proven deal experience are hallmarks of a reliable partner.

- Red flags like poor responsiveness or generic, one-size-fits-all advice can derail your transaction before it even starts.

Why Specialized M&A Law Firms Matter

Mergers and acquisitions are not standard legal transactions. They require a rare combination of legal skill, business understanding, industry expertise, and strategic insight. Specialized M&A law firms work in this space every day. They stay current on new market developments, regulations, and deal structures. They’ve handled everything from cooperative mergers to contested takeovers, and they know how to anticipate and manage risks that could jeopardize a transaction. Choosing a specialist means choosing a team that can protect your interests and support your broader business goals.

The Different Types of M&A Law Firms

Not all mergers and acquisitions law firms operate the same way. They vary in size, structure, and areas of focus. Understanding these differences helps you identify which type of firm best suits your deal.

Large Full-Service Firms (BigLaw, Multidisciplinary Teams, Global Reach)

Large, full-service law firms, often called “BigLaw,” are prominent in the legal market. They maintain offices in major cities around the world and provide a wide range of services. Their M&A divisions are usually large and include experts in all relevant areas such as tax, competition, employment, financing, real estate, and litigation. This unified approach can be helpful for transactions that involve multiple regions or complex legal issues. The downside is that these firms are often expensive, and their scale can make the client experience feel less personal.

Boutique M&A Firms (Specialized, Cost-Effective, More Hands-On)

Boutique M&A practices are built for focus and access. Their teams work on transactions every day, so you get specialist attention, faster decisions, and senior oversight from start to finish. The strongest boutiques bring tax into the file from the Letter of Intent (LOI) stage, so structure, pricing mechanics, and diligence move in steps, which often leads to smoother closings and better after-tax results. Because they avoid large-firm overhead, boutiques run lean, assemble the right experts when needed, and keep communication clear and direct, which is an effective model for mid-market transactions that prioritize speed, precision, and accountability.

Solo M&A Lawyers (Direct Access, Budget Control, Targeted Mandates)

An experienced solo practitioner can be a practical choice for smaller deals or distinct elements of a transaction. You get direct access to the lawyer doing the work, pragmatic advice, and tight control over budget and scope. That said, a solo usually does not have an in-house team, which matters in M&A when multiple workstreams and tight timelines converge. Competency varies by individual. Capacity can be a constraint, and the lawyer may need to coordinate external specialists for tax, employment, or financing issues.

Pros/Cons of Each Type Depending on Deal Size and Complexity

The most suitable M&A law firm for you depends on your deal’s scope and complexity. Large, cross-border transactions typically require the resources of a global firm. Smaller or mid-sized deals often benefit from the personal attention and lower costs of boutique firms. Their flexibility and focused knowledge can create a more efficient path to closing. In some cases, an experienced solo practitioner is a practical fit for smaller mandates, with the understanding that heavier diligence or multi-jurisdictional issues may require coordinating external specialists and careful timeline management.

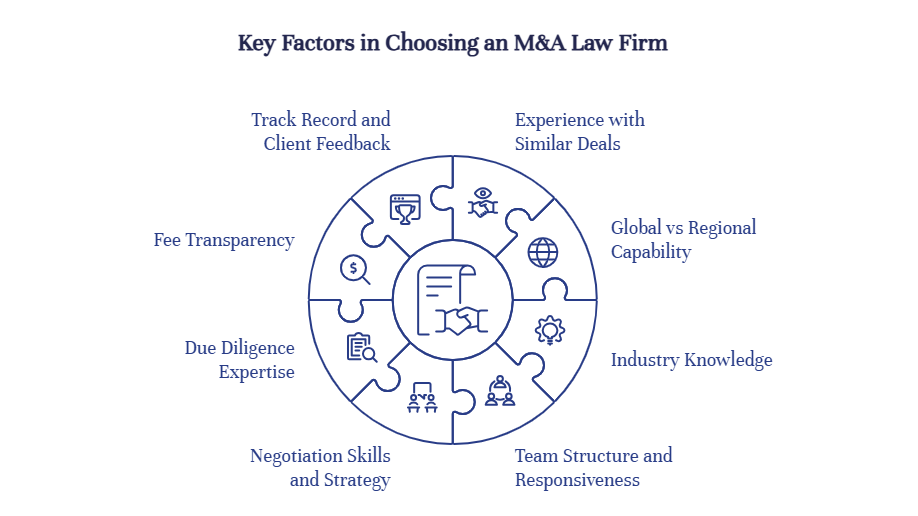

Your Checklist for Choosing the Right M&A Law Firm

Once you know what types of mergers and acquisitions law firms exist, the next step is evaluating your options. The checklist below outlines key factors to guide your decision-making process.

Experience With Deals Like Yours

Work with a firm that has a proven record of success handling deals similar to yours in size, sector, and structure. Ask detailed questions. How many transactions have they completed in your industry? What were the outcomes? Experience with similar deals allows a firm to anticipate hurdles and deliver practical solutions. The top M&A law firms often have dedicated groups that handle specific kinds of transactions.

Global vs Regional Capability

Confirm whether your deal needs global coverage or regional depth. For cross-border matters, look for teams that routinely manage foreign investment reviews, competition filings, multi-jurisdictional tax planning, data transfers, and diligence across multiple time zones. For regional or local transactions, prioritize firms with strong provincial or regional relationships, practical knowledge of the regulatory framework affecting your business activities, and the capacity to bring your deal to fruition.

Industry Knowledge

Your legal team should understand your industry inside and out. They should know the major players, market conditions, and relevant regulations. That insight allows them to offer informed advice and to recognize risks before they arise. A corporate lawyer in Montreal who already understands your market can save you time and money.

Team Structure and Responsiveness

M&A deals rely on collaboration. Ask who will lead your matter and who your main contact will be throughout the process. A strong team should be experienced, available, and committed to your success. Meet the lawyers who will be directly involved so you can assess their communication style and compatibility with your team.

Negotiation Skills and Strategy

Negotiation determines the value and success of an M&A deal. The firm you choose should be able to explain its approach clearly and show past results that demonstrate effective strategy. Ask whether they aim for cooperation or take a more hardline stance, and how they handle tense discussions. The best negotiators know how to balance assertiveness with problem-solving and build agreements that hold up over time.

Due Diligence Expertise

Thorough due diligence is essential in mergers and acquisitions. It involves reviewing the target company’s finances, contracts, and liabilities to uncover any potential issues. An experienced M&A law firm will have a structured review process that identifies problems early. For example, at Paquette Attorneys, we conduct due diligence before you purchase a company or its assets, including reviewing and revising contracts with employees and suppliers, and investigating pending lawsuits, debts, and certificates of good standing. Strong due diligence in mergers and acquisitions can prevent future disputes and make closing smoother. A firm’s knowledge in M&A legal due diligence can be the deciding factor between success and failure.

Fee Transparency

The cost of legal work in M&A can be substantial. Ask each firm how they bill — whether by the hour or through fixed fees — and what services are included. A transparent approach to billing is a sign of integrity. A firm willing to discuss fee options openly is often easier to work with throughout the transaction.

Track Record and Client Feedback (Proof They Can Close Deals)

Always check a firm’s references. Speak with recent clients to understand their experience. This can give you an honest view of the firm’s strengths and weaknesses. When it comes to law firm M&A, a consistent history of completed transactions matters. You want proof that they can manage negotiations, close deals, and keep clients satisfied.

Red Flags to Watch for When Evaluating M&A Law Firms

Selecting the right M&A law firm also means knowing what to avoid. Watch for warning signs as you review your options.

- Be cautious of any firm that hesitates to share information about its fees, experience, or team. Openness reflects confidence and professionalism. Since M&A transactions often move quickly, slow communication can signal future delays. If a firm takes too long to respond to early inquiries, that pattern will likely continue after engagement.

- Avoid firms that take a one-size-fits-all approach. Each deal has unique details that demand individual attention. Firms that fail to understand your business or sector can’t offer the tailored advice you’ll need. Look for firms that demonstrate a genuine understanding of your market and competitors.

- It’s also worth confirming who will actually handle your work. Sometimes, senior partners lead initial meetings while junior associates do most of the daily work. Make sure the people working on your deal have the right experience. The best mergers and acquisitions law firms maintain strong teams at every level.

How to Narrow Your Options

After you’ve done your initial research and identified a few likely candidates, the next step is to compare them in detail. Conduct interviews with your top choices. Ask detailed questions and evaluate how each firm communicates its experience.

Before each discussion, review the firm’s website, client testimonials, and recent transactions. Prepare thoughtful questions that require detailed explanations rather than simple yes or no answers. Listen carefully not only to what they say but to their tone and confidence. Do they communicate clearly? Do they show interest in understanding your goals?

The relationship you build with your M&A lawyers will be important throughout the process. Choose a firm that you feel confident working with and that you can trust to manage challenges effectively. If something feels off, trust your instincts and look elsewhere.

Finding the right M&A lawyers in Montreal is a serious decision that can influence the outcome of your transaction. By following this checklist and staying alert for red flags, you can find a firm that provides the experience, insight, and dependability your deal requires.

The process of identifying the best M&A law firms can seem complex, but a careful, step-by-step approach will make it easier. The right legal partner is out there — one that fits your goals, budget, and expectations.

Paquette Attorneys is a boutique commercial law firm focused on mid-market M&A, with senior-level involvement at every stage. If you’re evaluating counsel for a current or upcoming transaction, our M&A team can review your priorities, timelines, and fee options in a short call. Start here: Contact Paquette Attorneys.

About the Author

Me Jean-René Paquette is the founding attorney and president of Paquette Avocats in Kirkland, in the West Island. A bilingual corporate lawyer in Montréal, he focuses his practice on commercial mergers and acquisitions, labour and employment, distribution and complex contracts, advising entrepreneurs, SMEs and investors across a range of industries. Called to the Québec Bar in 2003, he brings more than 20 years of experience in structuring and securing transactions that support clients’ long-term growth.